Under the new law, seniors have the option to completely opt-out from no-fault allowable expense PIP benefits if they satisfy the following two conditions: 1.) The person is covered under Parts A and B of Medicare; and 2.) The person’s spouse and any resident relative has Medicare “qualified health coverage” or has no-fault PIP coverage under a separate policy.

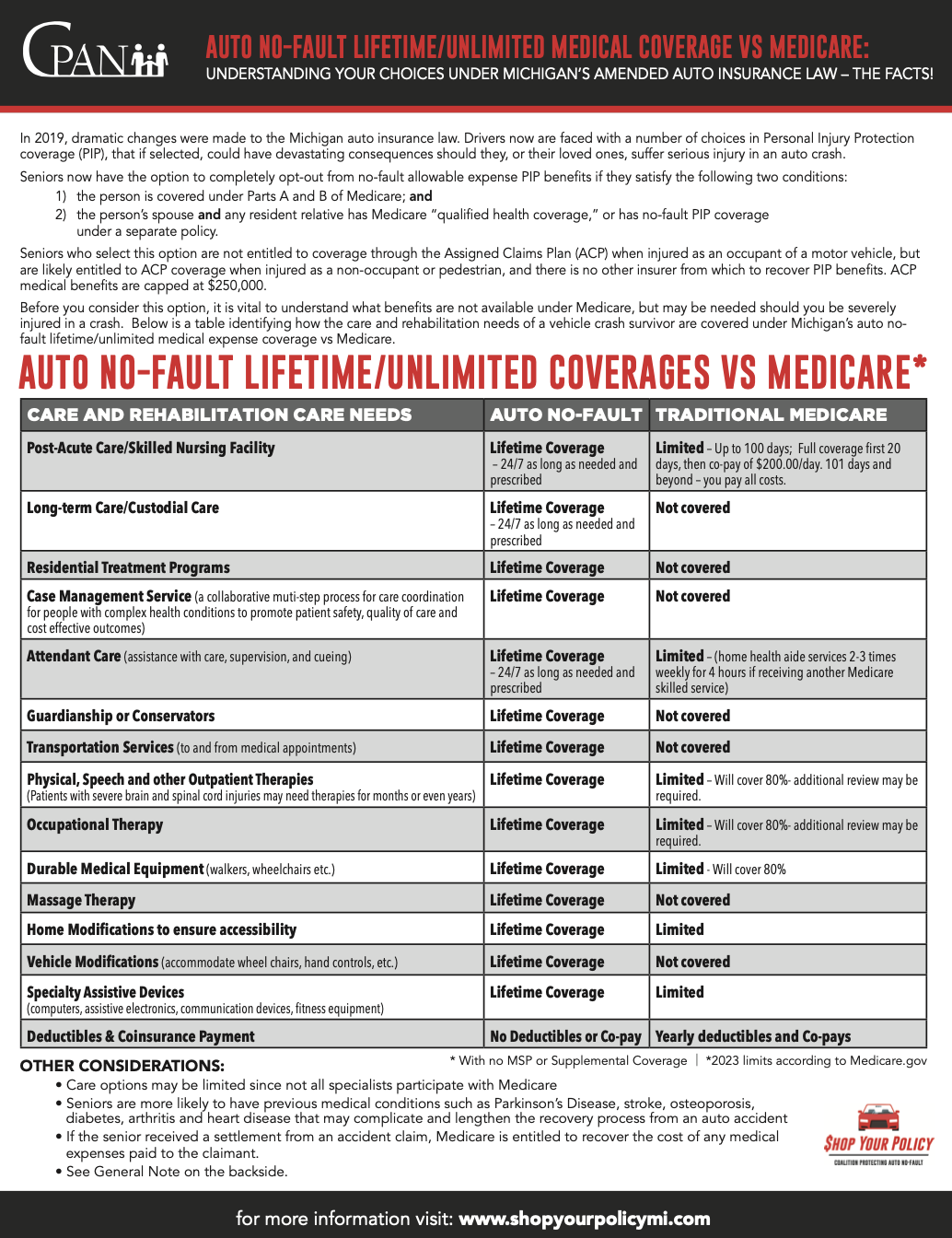

Before you consider this option, it is vital to understand what coverage is not available under Medicare but may be needed should you be severely injured in an accident. Please see the table below identifying the differences between what Medicare and no-fault lifetime/unlimited covers.